Understanding Average Collection Period: Calculation, Importance and Best Practices

Businesses can measure their average collection period by multiplying the days in the accounting period by their average accounts receivable balance. The average collection period is the length of time it takes for a company to receive payment from its customers for accounts receivable (AR). This metric is critical for companies that rely on receivables to maintain their cash flow and meet financial obligations. By measuring the typical collection period, businesses can evaluate how effectively they manage their AR and ensure they have enough cash on hand. The average collection period is an important accounting metric that evaluates a company’s ability to manage its accounts receivable (AR) effectively. It measures the time it takes for the business to collect payments from its clients, which reflects its cash flow effectiveness and ability to meet short-term financial obligations.

- To reduce ACP, a company can improve its invoicing process, follow up on overdue payments more aggressively, and review credit policies to ensure they are effective.

- By interpreting your organization’s average collection period, you can make informed decisions regarding collections policies, customer relationships, and the overall financial health of your business.

- As many professional service businesses are aware, economic trends play a role in your collection period.

Average Collection Period: Overview, Formula & Example

The average collection period is a measure of how efficiently a company manages its accounts receivable. Generally, a smaller average collection period is more desirable as it indicates that the company gets paid promptly. However, a short average collection period may also suggest that the credit terms are too restrictive, causing customers to switch to more lenient providers.

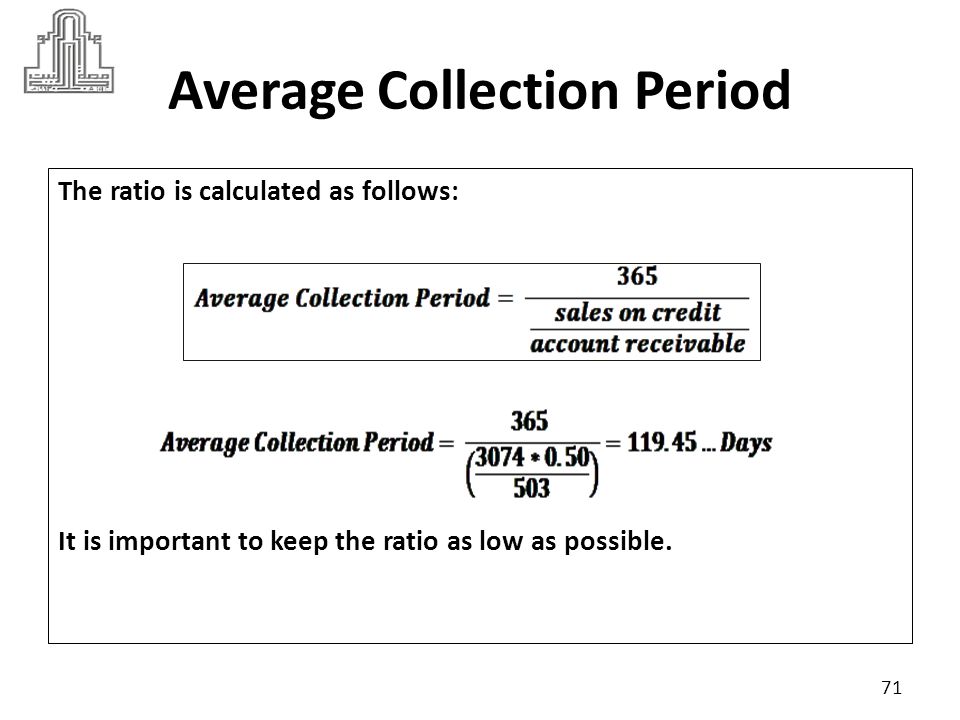

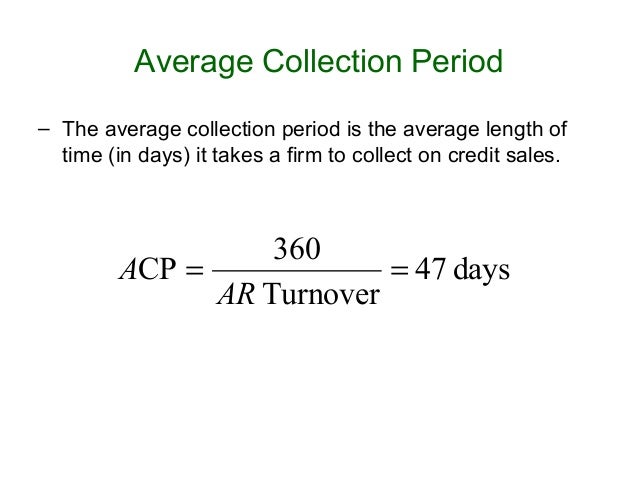

Formula

Companies strive to receive payments for goods and services they provide in a timely manner. Quick payments enable the organization to maintain the necessary level of liquidity to cover its own immediate expenses. Make sure the same period is being used for both net credit sales and average receivables by pulling the numbers from the same balance sheets. The accounts receivable collection period may be affected by several issues, such as changes in customer behaviour or problems with invoicing.

What Is the Average Collection Period Formula?

Similarly, inflation also negatively impacts consumers and businesses, often resulting in longer average collection periods. Average Collection Period plays a significant role in shaping credit terms and customer relationships. A shorter average collection period suggests that a company efficiently manages its receivables, while a longer one implies less effective AR management. The average collection period formula is the number of days in a period divided by the receivables turnover ratio.

Improve Liquidity

By carefully considering the impact of external factors on their business, companies can make informed decisions that maximize their cash flow while minimizing their days sales outstanding. Understanding the significance of an efficient collections process improvements to employee leave in nz payroll lies in its ability to ensure a company’s liquidity and short-term financial health. A shorter average collection period means a faster conversion of accounts receivables into cash, allowing for improved credit management and better cash flow control.

Professional services

A lower average collection period is generally more favorable than a higher one. A low average collection period indicates that the organization collects payments faster. Customers who don’t find their creditors’ terms very friendly may choose to seek suppliers or service providers with more lenient payment terms. For example, say you want to find Light Up Electric’s average collection period ratio for January. At the beginning of the month, your beginning balance of accounts receivable was $42,000, and your ending accounts receivable balance was $51,000.

Understanding these factors can help businesses optimize their collections processes and minimize Days Sales Outstanding (DSO). This section will cover three primary external factors—economic conditions, competition, and customer behavior—and how they influence a company’s average collection period. Let’s examine how an average collection period of 30 days compares with one of 60 days in a given industry. Companies with a 30-day average collection period are perceived as having more efficient AR management practices, while those with a 60-day average collection period may appear less so. A shorter collection period can lead to improved customer satisfaction, as clients receive their products or services sooner and can pay off their debts within the agreed credit terms. A low average collection period is crucial for businesses as it contributes significantly to their financial health and effective cash flow management.

Ideally, you should use the company’s credit sales, but such specific information is not always available. Alternatively, you can calculate the average collection period by dividing the number of days of a given period by the receivable turnover ratio. By understanding the accounts receivable collection period, businesses can identify any issues that may lead to cash flow problems and take steps to address them. The average collection period is a versatile tool that businesses use to forecast cash flow, evaluate loan conditions, track competitor performance, and detect early signs of poor debt allowances.

The AR value measures a company’s liquidity, as it indicates its ability to cover short-term debts without relying on additional cash flows. Typically, lower collection periods are preferred, as the shorter duration indicates more efficiency in credit collections. On the other hand, a high average collection period signals that a company might be taking too long to collect payments on their accounts receivables. Accounts receivables will vary greatly from one company to another, but it’s important to compare total credit sales with average collection periods to get a better understanding of a company’s cash flow.

This type of evaluation, in business accounting, is known as accounts receivables turnover. You can calculate it by dividing your net credit sales and the average accounts receivable balance. Alternatively, check the receivables turnover ratio calculator, which may help you understand this metric. The average collection period is a vital metric for businesses looking to optimize their cash flow management. It signifies the average number of days required for a company to collect its outstanding accounts receivables (AR).

Since Mosaic offers an out of the box billings and collections template, you can automatically surface outstanding invoices by due date highlighting exactly where to focus your collection efforts. As many professional service businesses are aware, economic trends play a role in your collection period. Seasonal fluctuations impact payment behaviors, which in turn affect your average collection period. In this article, we explore what the average collection period is, its formula, how to calculate the average collection period, and the significance it holds for businesses. This is the total amount of money your business is waiting to receive from customers. In the long run, you can compare your average collection period with other businesses in the same field to observe your financial metrics and use them as a performance benchmark.