We expect to offer our courses in additional languages in the future but, at this time, HBS Online can only be provided in English. Cash flow is typically depicted as being positive (the business is taking in more cash than it’s expending) or negative (the business is spending more cash than it’s receiving). An investor wants to closely analyze how much and how often a company raises capital and the sources of the capital.

Accounting Research Online

Negative cash flow from investing activities might be due to significant amounts of cash being invested in the company, such as research and development (R&D), and is not always a warning sign. It is calculated by taking cash received from sales and subtracting operating expenses that were paid in cash for the period. The direct and indirect methods will result in the same number, but the process of calculating cash flow from operations differs. The cash flow statement is useful when analyzing changes in cash flow from one period to the next as it gives investors an idea of how the company is performing.

Investing Cash Flow

By studying the CFS, an investor can get a clear picture of how much cash a company generates and gain a solid understanding of the financial well-being of a company. Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning. As we have seen from our financial model example above, it shows all the historical data in a blue font, while the forecasted data appears in a black font.

Cash Flow Statement Outline

- As a result, the amount of the company’s long-term liabilities increased, as did its cash balance.

- This cash flow statement is for a reporting period that ended on Sept. 28, 2019.

- Cash flow statements display the beginning and ending cash balances over a specific time period and points out where the changes came from (i.e operating activities, investing activities, and financing activities).

- In these cases, revenue is recognized when it is earned rather than when it is received.

- It produces what is called the net cash flow by breaking down where the changes in the beginning and ending balances came from.

This information is important in making crucial decisions about spending, investments, and credit. The cash flow statement will not present the net income of a company for the accounting period as it does not include non-cash items which are considered by the income statement. It is useful to see the impact and relationship that accounts on the balance sheet have to the net income on the income statement, and it can provide a better understanding of the financial statements as a whole. As we have discussed, the operating section of the statement of cash flows can be shown using either the direct method or the indirect method.

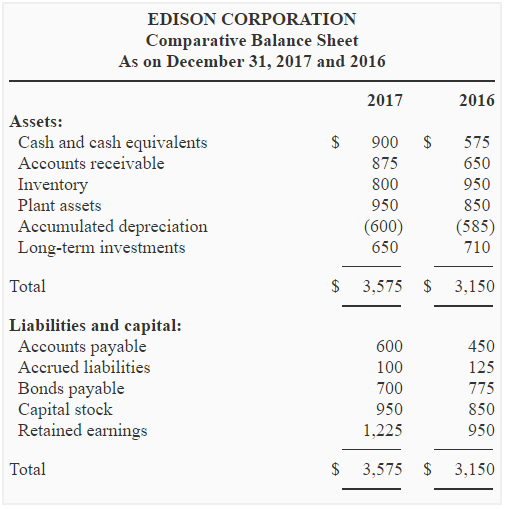

REVIEW PROBLEM 12.4

The increase was primarily driven by higher variable content costs, including higher third-party digital costs and podcast profit sharing expenses related to the increase in digital revenues. The price-to-cash flow (P/CF) ratio compares a stock’s price to its operating cash flow per share. P/CF is especially useful for valuing stocks with a positive cash flow but that are not profitable because of large non-cash charges. Cash flow from financing activities provides investors with insight into a company’s financial strength and how well its capital structure is managed.

How Are Cash Flows Different From Revenues?

A positive net cash flow indicates a company had more cash flowing into it than out of it, while a negative net cash flow indicates it spent more than it earned. The first step in preparing a cash flow statement is determining the starting balance of cash and cash equivalents at the beginning of the reporting period. This value can be found on the income statement of the same accounting period. The main components of a cash flow statement are cash flows from operating activities, investing activities, and financing activities. A statement of cash flows contains information about the flows of cash into and out of a company, and the uses to which the cash is put.

The investing activities section of the SCF reports the cash inflows and cash outflows related to the changes that occurred in the noncurrent (long-term) assets section of the balance sheet. Under the indirect method, the SCF section cash flows from operating activities begins with the amount of net income, which is taken from the company’s income statement. Since the net income was based on the accrual method of accounting, the amount of net income must be adjusted to the cash amount. A cash flow statement is one of three core financial statements released by publicly traded companies when they report earnings quarterly and annually. Many companies have such large businesses that they show numbers on their cash flow statement in thousands or in millions—if they do, there will be a note at the top of the statement explaining this. The current asset rule states that increases in current assets are deducted from net income.

The following sample journal entries are reminders of transactions that involve cash. The Cash account is either debited or credited, to indicate a cash inflow or cash outflow, respectively. The ending cash balance should agree with the amount reported as cash on the company’s December 31, 2023 balance sheet.

You can also see that Apple spent a lot of money on share buybacks (repurchases of common stock) and dividend payments. It’s important to understand that revenue and net income (earnings) are not the same as cash gained by the business. Creditors are interested in understanding a company’s track record of repaying debt, as well as understanding how much debt the company has already taken out. If the company is highly leveraged qualifying for a mortgage with 2 primary residences and has not met monthly interest payments, a creditor should not loan any money. Alternatively, if a company has low debt and a good track record of debt repayment, creditors should consider lending it money. The Company’s Audio & Media Services reportable segment includes Katz Media Group, the nation’s largest media representation company, and RCS, the world’s leading provider of broadcast and webcast software.

However, these documents serve distinct purposes and offer different insights into your organization’s financial health. A cash flow statement is a financial report that details how cash entered and left a business during a reporting period. The cash flow statement does not replace the income statement as it only focuses on changes in cash. In contrast, the income statement is important as it provides information about the profitability of a company. Using this method, cash flow is calculated through modifying the net income by adding or subtracting differences that result from non-cash transactions. Under U.S. GAAP, interest paid and received are always treated as operating cash flows.