Such stock, which is held in the corporate treasury, loses its right to vote, receive dividends, or receive assets upon liquidation. Gain unlimited access to more than 250 productivity Templates, CFI’s full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more. Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI’s full course catalog and accredited Certification Programs. For another example, assuming the company ABC only pays the amount of only $200,000 on August 31, for reacquisition of the 100,000 shares of the stock above instead. This situation is typically encountered only in companies with relatively few stockholders. After appropriate approvals, the corporation may act to acquire shares for the purpose of retiring them.

The Difference Between Treasury Shares & Retired Shares

Investors benefit from a higher ownership stake in the company and greater returns. The key difference between the constructive retirement method and the cost method is that the constructive retirement method does not involve the treasury stock account. On the balance sheet, treasury stock is listed under shareholders’ equity as a negative number. Companies buy back their shares for a variety of reasons, which include boosting the share price, the earnings per share, consolidation of ownership, reducing the cost of capital, and providing an increase in value to investors.

Would you prefer to work with a financial professional remotely or in-person?

- Many companies buy back their own shares with retained earnings for a variety of reasons.

- How the company accounts for those shares determines whether this stock is treasury stock or retired stock.

- This can be matched with static or increased demand for the shares, which also has an upward pressure on price.

- For instance, the company’s earnings per share (EPS) may increase because the payments are divided among a smaller number of outstanding shares.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. In effect, the balance of the Treasury Stock contra account is closed into the balance of the Common Stock account.

How Treasury Stock Is Recorded

A company that announces a treasury stock program usually sets a purchase limit, but how much is repurchased? The execution rate is the number of shares bought back as a percentage of the total number of shares in the plan. If the execution rate is high, the company is actively buying back shares; if it is low, it may have reservations about the market. When shares are repurchased, the treasury stock account is debited to decrease total shareholders’ equity.

How do Companies Perform a Buyback of Stocks?

Before introducing treasury stock, let me introduce you to a company in Taiwan that is applying for a listing. The company’s paid-in capital must reach NT$600 million or more, and the number of common shares to be issued must reach 30 million or more. After listing or listing on the Taiwan Stock Exchange, these shares will be circulated to the secondary market, where we usually place our orders and become the so-called ‘Outstanding Stocks’! Simply put, treasury stock is when a company uses cash to buy back its shares! Imagine a company is like a shopkeeper who likes his products, and when he sees that they are selling well, he chooses to repurchase some of them.

Lastly, treasury stock can be necessary for safeguarding a company’s autonomy! It also allows the management to focus more resources on the company’s long-term growth and value creation. When a company buys back its shares, they are recorded in its account and can be converted to preferred shares or bonds at any time. This makes treasury shares a powerful tool for navigating market volatility and responding to various situations. Corporations issue stock for a variety of reasons, including the need to raise money for operating capital and to expand operations or pay off debt.

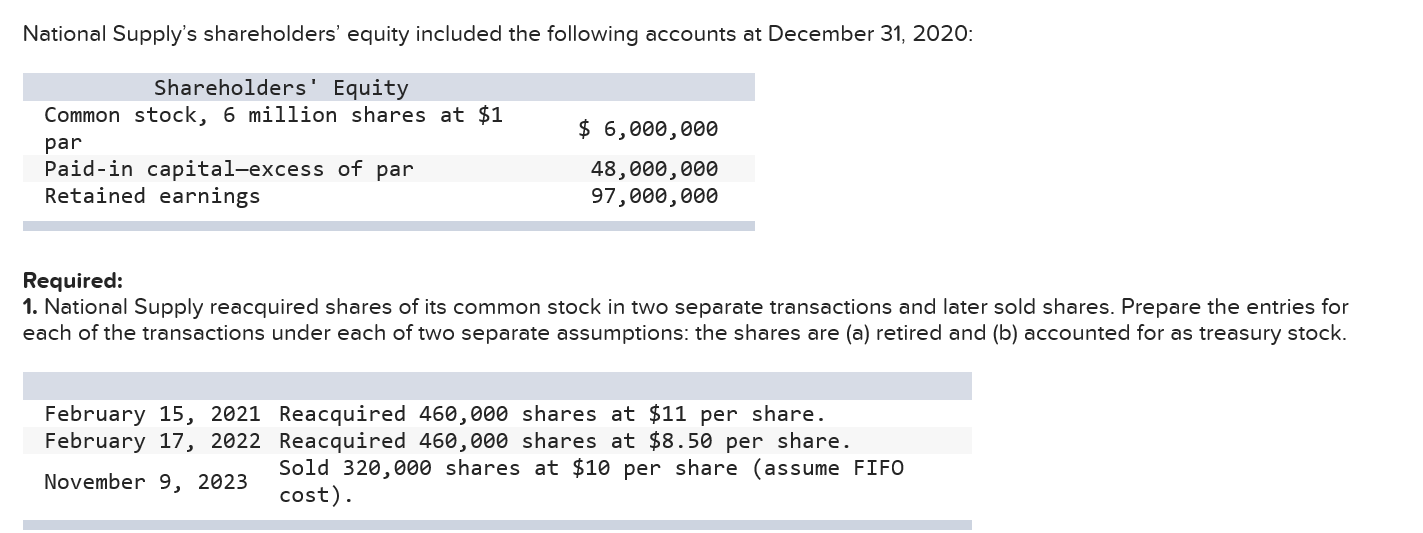

The remainder of the purchase price is debited to the retained earnings account. Treasury stock, or reacquired stock, is the previously issued, outstanding shares of stock which a company repurchased or bought back from shareholders. They can either remain in the company’s possession to be sold in the future, or the business can retire the shares and they will be permanently out of market circulation. In this journal entry, there is no impact on total equity on the balance sheet as the debits and credit are all in the equity section.

All of our content is based on objective analysis, and the opinions are our own. This arrangement tends to reduce the investor’s risk of a decreased market value. Look for the company name and location of incorporation, a CUSIP number, and the name of the person with whom the security is registered. All of these items are important and can likely be found on the certificate’s face.

If the treasury stock is resold later, the cash account is increased through a debit while the treasury stock account is decreased. This increases total shareholders’ equity through a credit notation on the balance sheet. Retired shares are treasury shares that have been repurchased by the issuer out of the company’s retained earnings and permanently canceled. While other treasury shares can be reissued or sold 70 love words and messages to show you care on the open market, retired shares cannot be reissued, they have no market value and they no longer represent a share of ownership in the issuing corporation. Retired shares will not be listed as treasury stock on a company’s financial statements. The retirement of treasury stock involves the buyback of a company’s own shares and then permanently canceling them to make them unavailable on the open market.