The next step in understanding RoR over time is to account for the time value of money (TVM), which the CAGR ignores. Discounted cash flows take the earnings of an investment and discount each of the cash flows based on a discount rate. The discount rate represents a minimum rate of return acceptable to the investor, or an assumed rate of inflation. In addition to investors, businesses use discounted cash flows to assess the profitability of their investments. The accounting rate of return (ARR) is a simple formula that allows investors and managers to determine the profitability of an asset or project. Because of its ease of use and determination of profitability, it is a handy tool to compare the profitability of various projects.

How to Calculate ARR (Accounting Rate of Return)?

A company is considering in investing a project which requires an initial investment in a machine of $40,000. Net cash inflows of $15,000 will be generated for each of the first two years, $5,000 in each of years three and four and $35,000 in year five, after which time the machine will be sold for $5,000. The Accounting rate of return is used by businesses to measure the return on a project in terms of income, where income is not equivalent to cash flow because of other factors used in the computation of cash flow. Calculating ARR or Accounting Rate of Return provides visibility of the interest you have actually earned on your investment; the higher the ARR the higher the profitability of a project.

Do you own a business?

Note that actual returns vary widely from year to year, and from stock to stock. If you’re making long-term investments, it’s important that you have a healthy cash flow to deal with any unforeseen events. Find out how GoCardless can help you with ad hoc payments double entry accounting defined and explained or recurring payments. The accounting rate of return percentage needs to be compared to a target set by the organisation. If the accounting rate of return is greater than the target, then accept the project, if it is less then reject the project.

- In addition, ARR does not account for the cash flow timing, which is a critical component of gauging financial sustainability.

- ARR illustrates the impact of a proposed investment on the accounting profitability which is the primary means through which stakeholders assess the performance of an enterprise.

- Further management uses a guideline such as if the accounting rate of return is more significant than their required quality, then the project might be accepted else not.

- The accounting rate of return (ARR) is a financial ratio of Average Profit to the Average Investment made in the particular project.

- Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism.

How Does Depreciation Affect the Accounting Rate of Return?

If you choose to complete manual calculations to calculate the ARR it is important to pay attention to detail and keep your calculations accurate. If your manual calculations go even the slightest bit wrong, your ARR calculation will be wrong and you may decide about an investment or loan based on the wrong information. Hence using a calculator helps you omit the possibility of error to almost zero and enable you to do quick and easy calculations. Using the ARR calculator can also help to validate your manual account calculations. Depreciation is a direct cost that reduces the value of an asset or profit of a company. As such, it will reduce the return on an investment or project like any other cost.

Whereas average profit is fairly simple to calculate, there are several ways to calculate the average book value of investment. The ARR can be used by businesses to make decisions on their capital investments. It can help a business define if it has enough cash, loans or assets to keep the day to day operations going or to improve/add facilities to eventually become more profitable. For those new to ARR or who want to refresh their memory, we have created a short video which cover the calculation of ARR and considerations when making ARR calculations. Very often, ARR is preferred because of its ease of computation and straightforward interpretation, making it a very useful tool for business owners, key stakeholders, finance teams and investors.

Of course, that doesn’t mean too much on its own, so here’s how to put that into practice and actually work out the profitability of your investments. For a project to have a good ARR, then it must be greater than or equal to the required rate of return. Candidates should note that accounting rate of return can not only be examined within the FFM syllabus, but also the F9 syllabus. Recent FFM exam sittings have shown that candidates are struggling with the concept of the accounting rate of return and this article aims to help candidates with this topic.

Accounting Rate of Return (ARR) is one of the best ways to calculate the potential profitability of an investment, making it an effective means of determining which capital asset or long-term project to invest in. Find out everything you need to know about the Accounting Rate of Return formula and how to calculate ARR, right here. Candidates need to be able to calculate the accounting rate of return, and assess its usefulness as an investment appraisal method.

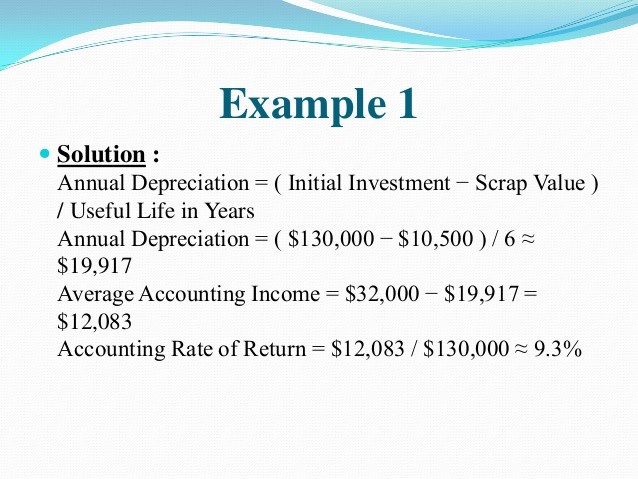

The accounting rate of return is a capital budgeting indicator that may be used to swiftly and easily determine the profitability of a project. Businesses generally utilize ARR to compare several projects and ascertain the expected rate of return for each one. The Accounting Rate of Return formula is straight-forward, making it easily accessible for all finance professionals. It is computed simply by dividing the average annual profit gained from an investment by the initial cost of the investment and expressing the result in percentage. The ARR is the annual percentage return from an investment based on its initial outlay.

Read on as we take a look at the formula, what it is useful for, and give you an example of an ARR calculation in action. If so, it would be great if you could leave a rating below, it helps us to identify which tools and guides need additional support and/or resource, thank you. Ask a question about your financial situation providing as much detail as possible. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

ICalculator helps you make an informed financial decision with the ARR online calculator. You just have to enter details as defined below into the calculator to get the ARR on any particular project running in your company. Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.